south san francisco sales tax 2019

This is the total of state county and city sales tax rates. The City of Phenix City has increased their sales tax rate by 50 which will increase the total rate depending on if the sale is in Russell County 95 or.

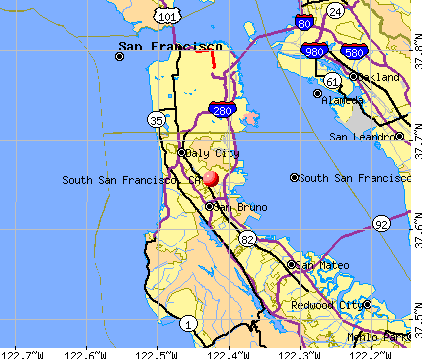

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Ad Lookup Sales Tax Rates For Free.

. 305 Dna Way South San Francisco CA 94080. CA Sales Tax Rate. They do not need to file a Payroll.

The tax will be imposed at a rate between 0175 percent and 069 percent of San Francisco gross receipts over 50 million depending on the type of business and an additional 15 percent of the payroll expense in San Francisco. Click to see full answer. For tax rates in other cities see.

The San Mateo County sales tax rate is 025. As usual July 1st of each year brings many sales andor use tax changes. Currently the cumulative tax on retail sales in South San Francisco is 9 of the purchase price.

House located at 3655 Bassett Ct SOUTH SAN FRANCISCO CA 94080 sold for 1138888 on Aug 15 2019. The San Francisco sales tax rate is 0. The partial exemption rate is 39375 percent making the partial sales and use tax rate equal to 45625 percent for San Francisco County and 53125 percent for South San Francisco San Mateo County.

The December 2020 total local sales tax. Payroll tax of 328 on payroll expense attributable to the City5 Commercial Rents Tax Effective January 1 2019 San Francisco joins the New York City borough of Manhattan in imposing a commercial rents tax6 Unlike Manhattan San Franciscos Commercial Rents Tax will be imposed on the landlord not the. South El Monte 10250.

In light of the COVID-19 public health crisis and shelter-in-place orders in effect in San Francisco the sale scheduled for May 1 2020 through May 4 2020 has been cancelled. Tax returns are required monthly for all hotels and motels operating in the city. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax.

Similarly you may ask what is the sales tax in San Francisco 2019. Welcome to 3655 Bassett Ct a spacious 4 bed 2 b. The California sales tax rate is currently 6.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. The current Transient Occupancy Tax rate is 14. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division.

The minimum combined 2022 sales tax rate for San Francisco California is 863. Information and Tax Returns for the collection of Transient Occupancy Tax and Conference Center Tax in South San Francisco is available below. The current Conference Center Tax is 250 per room night.

The San Francisco sales tax rate is 850. Auction Site bid4assets Timeshare Parcels. The December 2020 total local sales tax rate was 9750.

New South San Francisco tax could help solve traffic congestion commute woes. 2019 Public Auction. The minimum combined 2020 sales tax rate for South San Francisco California is 975.

ALABAMA The Dallas County Commission has imposed an additional one-half percent sales tax for public school purposes. 715 AC MOL PARCEL 1 PARCEL MAP VOL 7871-72. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo Adelanto 7750 San Bernardino.

South San Francisco. You can print a 9875 sales tax table here. On a taxable sales transaction of one dollar South San Francisco currently receives one cent from the State and the remainder is paid to other public agencies including the State and the County.

The current total local sales tax rate in San Francisco CA is 8625. South San Francisco in California has a tax rate of 925 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in South San Francisco totaling 175. Here is our list.

The California sales tax rate is currently 6. The current total local sales tax rate in South San Francisco CA is 9875. Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2019 as defined in Code section 62-12 qualified by Code sections 9523 f and g were not otherwise exempt under Code sections 906 or 954 2105 and 2805 except as follow.

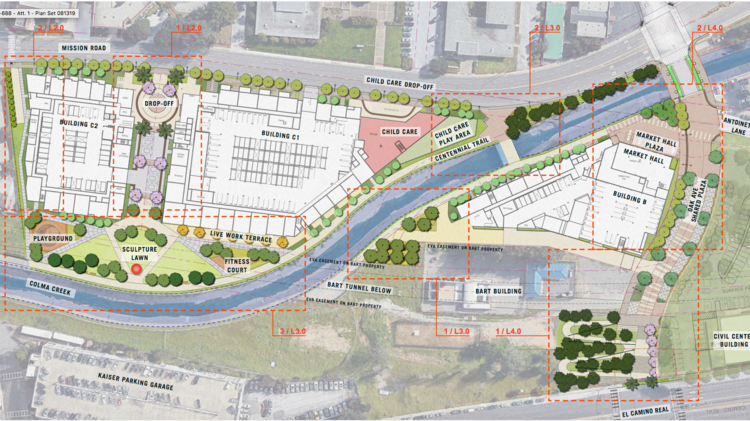

By 2040 South San Francisco City officials predict the number of employees working east of Highway. There is no applicable city tax. This is the total of state county and city sales tax rates.

San Francisco CA Sales Tax Rate. 1788 rows South Dos Palos. What is the sales tax rate in San Francisco California.

4 beds 2 baths 1820 sq. Auction Site bid4assets Parcels Other Than Timeshares. The December 2019 total local sales tax rate was also 8500.

The County sales tax rate is 025. Interactive Tax Map Unlimited Use.

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

South San Francisco Approves 800 Homes Near Bart At 1051 Mission St San Francisco Business Times

Finance Department City Of South San Francisco

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Building Division City Of South San Francisco

Finance Department City Of South San Francisco

Building Division City Of South San Francisco

Building Division City Of South San Francisco

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders